Minimum Amount To File Taxes 2024. If your gross income exceeds the required filing threshold, you must file taxes. The irs is currently planning for a threshold of $5,000 for tax year 2024 (the taxes you file in 2025) as part of the phase in to implement the lower over $600 threshold enacted.

The 2023 standard deduction for tax returns filed in 2024 is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household.

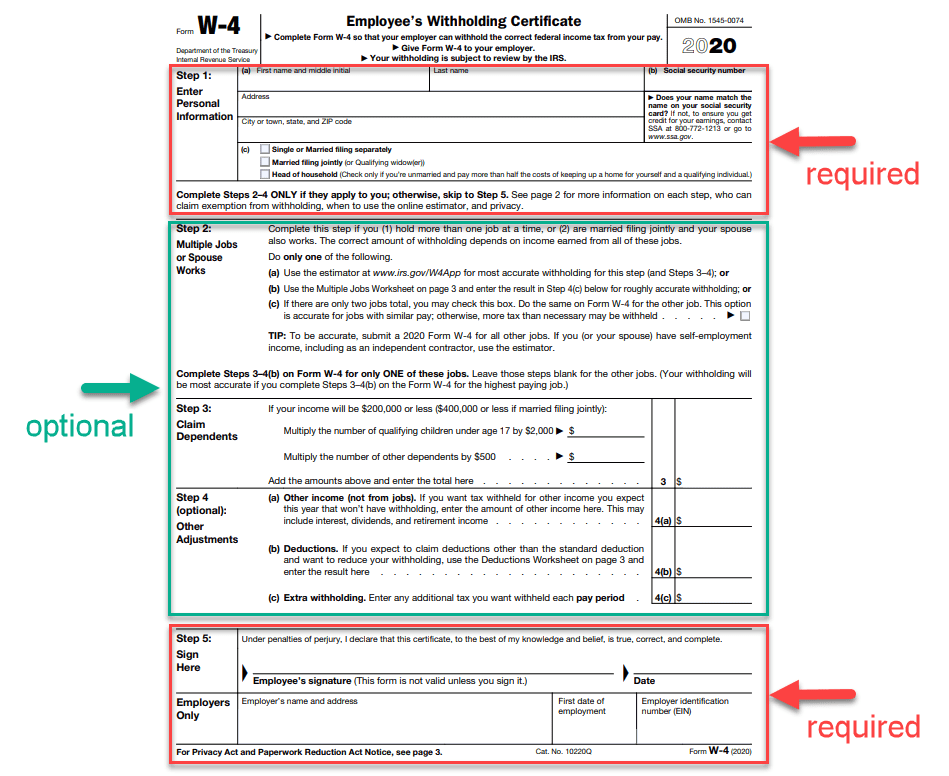

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The irs begins accepting tax year 2023 returns on jan. A dependent's income can be unearned when it comes from sources like dividends or interest payments.

How to Know the Minimum Amount to File Taxes, This amount is $13,850 in 2023 ($14,600 in 2024). The irs begins accepting tax year 2023 returns on jan.

IRS Refund Schedule 2024 When To Expect Your Tax Refund, If you have net earnings of. If you are unable to file before that date, you still have options.

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, If you’re under 65, you probably have to file a tax return in 2024 if your 2023 gross income was at least $13,850 as a. For tax year 2024, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses:

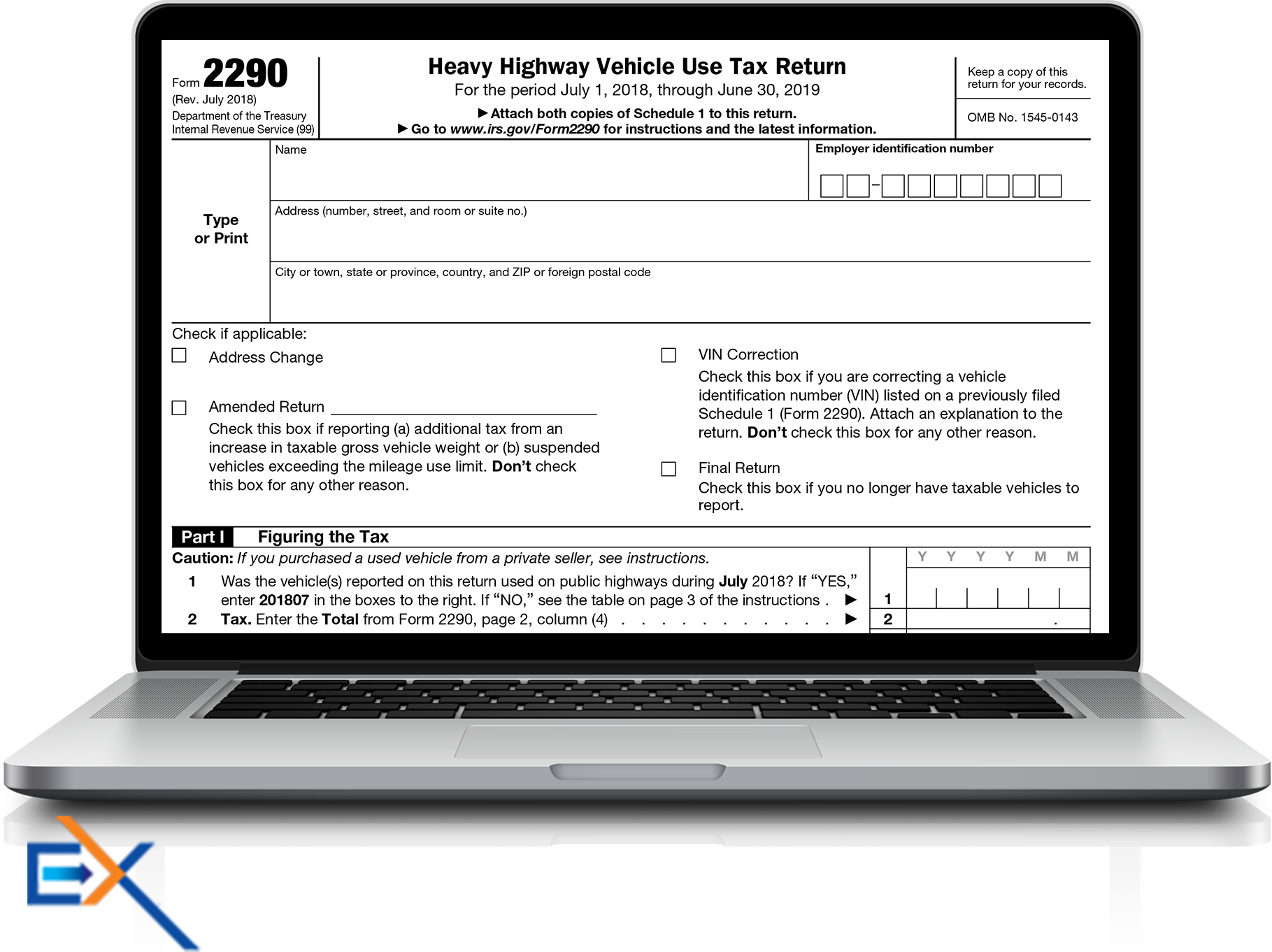

PreFile 2290 Form Online for 20232024 Tax Year & Pay HVUT Later, Generally, you need to file if: If you file on paper , you should receive your income tax package in the mail by this date.

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, You can file for an extension. Minimum income requirements for filing a 2023 tax return.

Federal Standard Deduction 2024 Audrye Jacqueline, Citizens or permanent residents who work in the u.s. A dependent's income can be unearned when it comes from sources like dividends or interest payments.

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, If you file on paper , you should receive your income tax package in the mail by this date. What is the minimum income to file taxes?

Tax Return for FY 202324 Last Date and Deadline; Easy and, Here’s a brief overview for the 2023 tax year, showcasing the minimum income required to file taxes based on your filing status and age: The agency expects more than 128 million returns to be filed before the official tax deadline on april 15, 2024.

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Tax brackets the irs increased its tax brackets by about 5.4% for each type of tax filer for 2024, such as those filing. Your gross income is over the filing.

The irs is currently planning for a threshold of $5,000 for tax year 2024 (the taxes you file in 2025) as part of the phase in to implement the lower over $600 threshold enacted.